«They must listen and take it into account», Kiseliova on the city council members' appeal not to raise taxes for entrepreneurs

- News of Mykolaiv

-

•

-

- Anna Hakman

-

•

-

15:52, 03 February, 2026

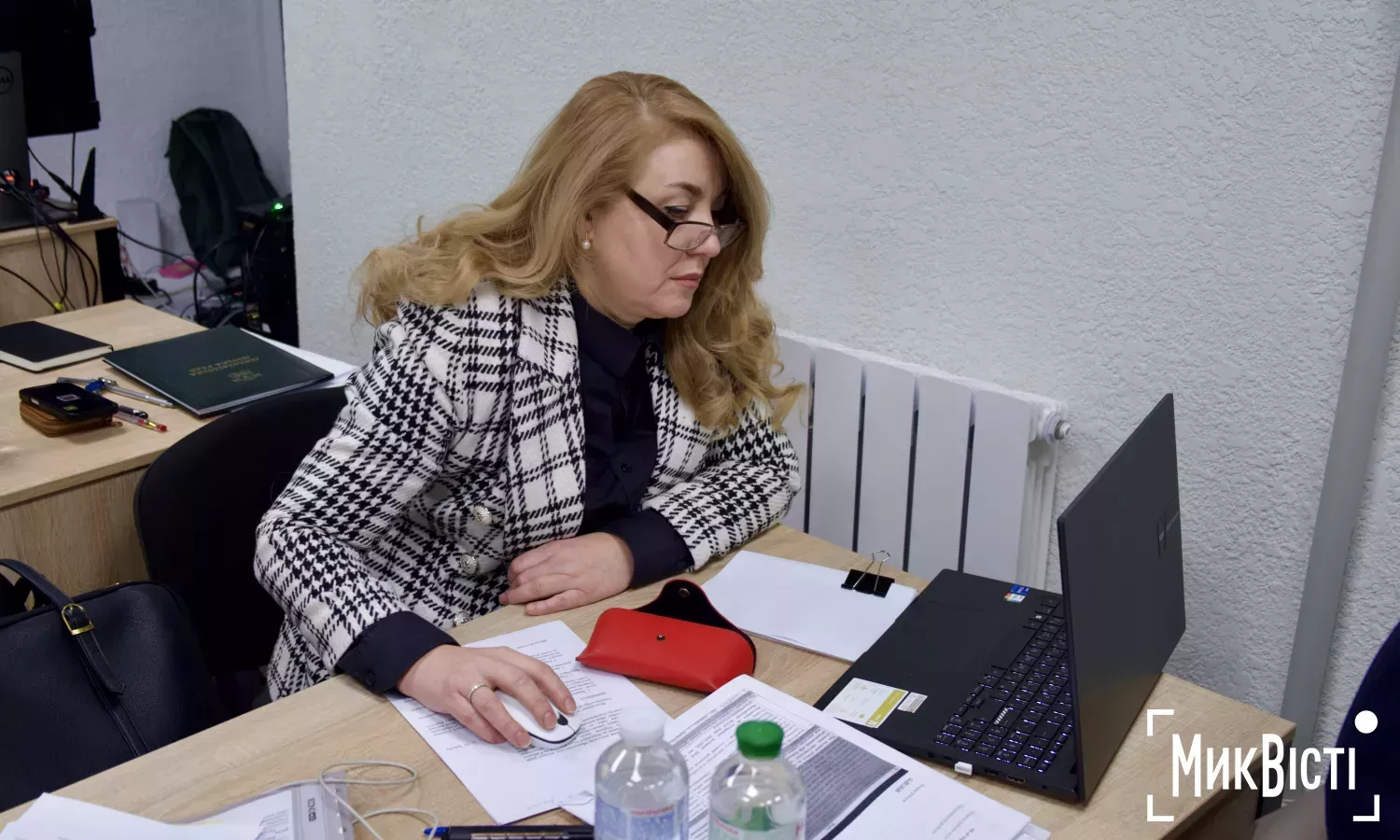

Mykolaiv City Council deputy Olena Kiseliova believes that members' appeals not to increase the tax burden on local entrepreneurs should be «heard and taken into account».

She said this in a comment to NikVesti.

As is known, deputies of the Mykolaiv City Council appealed to President of Ukraine Volodymyr Zelenskyy, the Verkhovna Rada and the Cabinet of Ministers with a demand not to increase the tax burden on local entrepreneurs.

«I sincerely believe that when local councils, entrepreneurs and every member in their professional activities pay attention to these issues and convey this to the initiators of draft laws, they should be heard and taken into account. I have been working in this field for a long time and I know very well how the simplified taxation system came into being, how it supported the development of Ukraine and small and medium-sized businesses, some of which have now become large. In other words, Ukraine's economic model was very dependent on single tax payers,» said Olena Kiseliova.

As is well known, in particular, there are plans to introduce an additional tax burden for individual entrepreneurs with an annual income of more than one million hryvnias — they will be required to pay value added tax.

«The aim of the bill is to increase budget revenues. The second is to combat smuggling at customs. But even those entrepreneurs who are simply going about their business are affected by this noble idea. For example, photographers, hairdressers, tutors, IT specialists — those who have nothing to do with the movement of goods through customs. It turns out that if they sell services or goods worth one million hryvnias, they automatically become value added tax payers,» concluded Olena Kiseliova.

Text of the appeal of the deputies of the Mykolaiv City Council of the VIII convocation to the Verkhovna Rada of Ukraine and the Cabinet of Ministers of Ukraine regarding the prevention of an increase in the tax burden:

It should be noted that on 27 November, it became known that Ukraine had agreed to new requirements from the International Monetary Fund, which, in particular, provide for the abolition of some tax breaks. This is a condition for receiving the next IMF loan tranche.

In particular, it is planned to introduce an additional tax burden for individual entrepreneurs with an annual income of more than one million hryvnias — they will be required to pay value added tax.

This information was later officially confirmed by the IMF, which emphasised thatUkraine's compliance with the Fund's requirements is a necessary condition for the provision of an $8 billion loan.

In turn, the head of the parliamentary committee on finance, tax and customs policy, Danylo Hetmantsev, said that the introduction of value added tax for individual entrepreneurs was primarily the fault of «cunning» big business and the insufficient work of tax authorities.

Recently, on 12 January, the Association of Ukrainian Cities appealed to the Cabinet of Ministers, the Verkhovna Rada and the President of Ukraine regarding the inadmissibility of introducing a mandatory value added tax for single tax payers.

The appeal emphasises that the introduction of VAT for the simplified taxation system could lead to the shadowing of business, job cuts and, as a result, a reduction in local budget revenues. The mayor of Mykolaiv, Oleksandr Sienkevych, also took part in this process.

Read the article NikVesti: «How business in Mykolaiv operates in conditions of power outages».

Чому ви читаєте «МикВісті»? Яка наша діяльність найбільш важлива для вас? Та чи хотіли б ви стати частиною спільноти читачів? Пройдіть опитування, це анонімно і займе 5 хвилин вашого часу